Investment Guide

We present a detailed overview of the key sectors in the Ukrainian economy. These sectors are critical for national development and have significant global potential. Investing in these areas will contribute to the comprehensive growth of the economy and enhance related sectors.

The convergence of strong international support, EU accession prospects, and global economic trends create an optimal environment for investments in Ukraine. Reconstruction needs, supported by substantial financial backing, offer significant opportunities for investors.

For those wanting to learn more about Ukraine’s economy and sectors. Gain insights into the overall economic landscape and key industries.

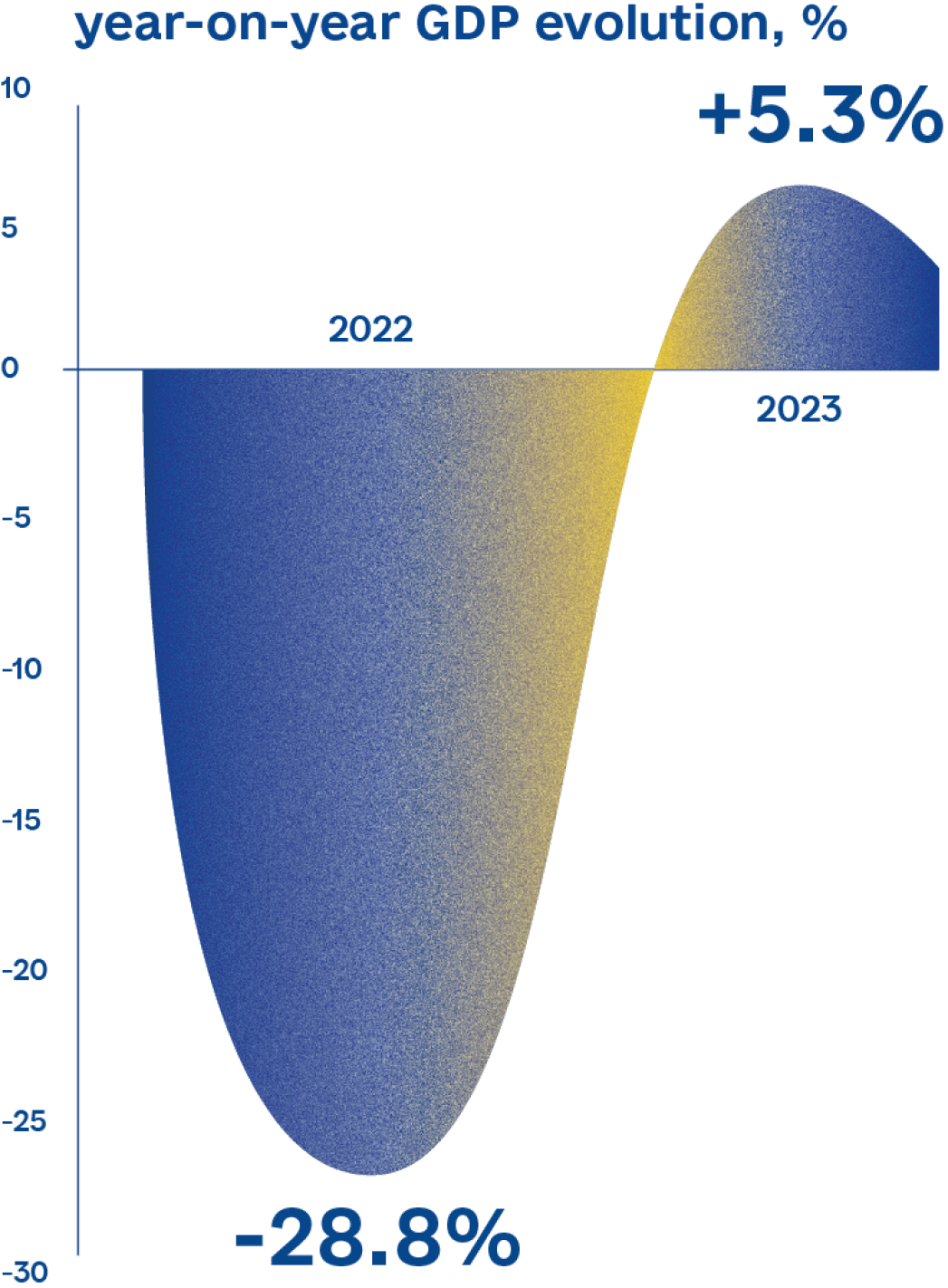

In 2022, Ukraine’s GDP contracted by a record 28.8% due to Russia’s unprovoked aggression but rebounded impressively in 2023 with 5.3% growth, driven by policy adjustments such as suspending regulations, relocating businesses, and investing in energy infrastructure. The recovery, aided by stable energy supplies and favourable weather, resulted in a 7.2% increase in household consumption and a 52.9% boost in gross fixed capital formation from defence and infrastructure investments. However, a rise in imports by 8.5% and a 5.4% drop in exports moderated the overall GDP growth.

In 2022, Ukraine’s GDP contracted by a record 28.8% due to Russia’s unprovoked aggression but rebounded impressively in 2023 with 5.3% growth, driven by policy adjustments such as suspending regulations, relocating businesses, and investing in energy infrastructure. The recovery, aided by stable energy supplies and favourable weather, resulted in a 7.2% increase in household consumption and a 52.9% boost in gross fixed capital formation from defence and infrastructure investments. However, a rise in imports by 8.5% and a 5.4% drop in exports moderated the overall GDP growth.

However, the economic uplift was moderated by an 8.5% rise in imports driven by growing consumer and investment demands, alongside a 5.4% decrease in exports. These shifts underscore the persistent challenges and the resilience of Ukraine’s economy amidst ongoing adversities.

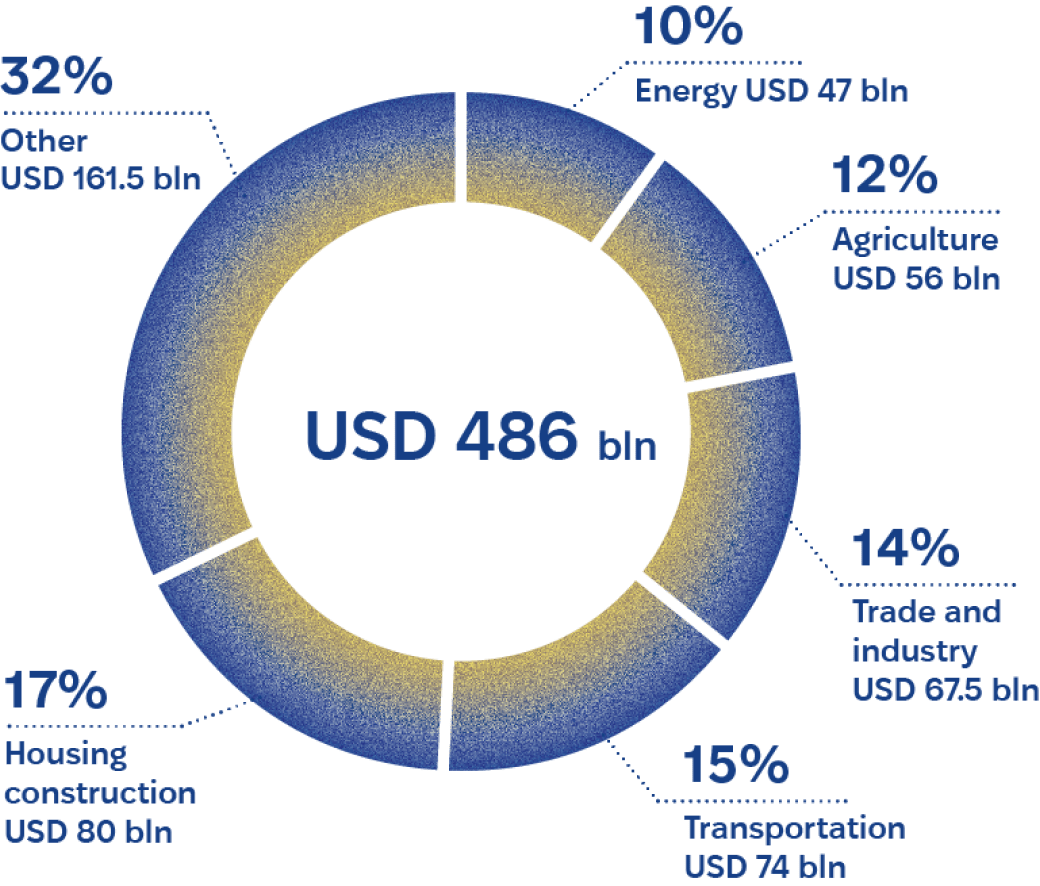

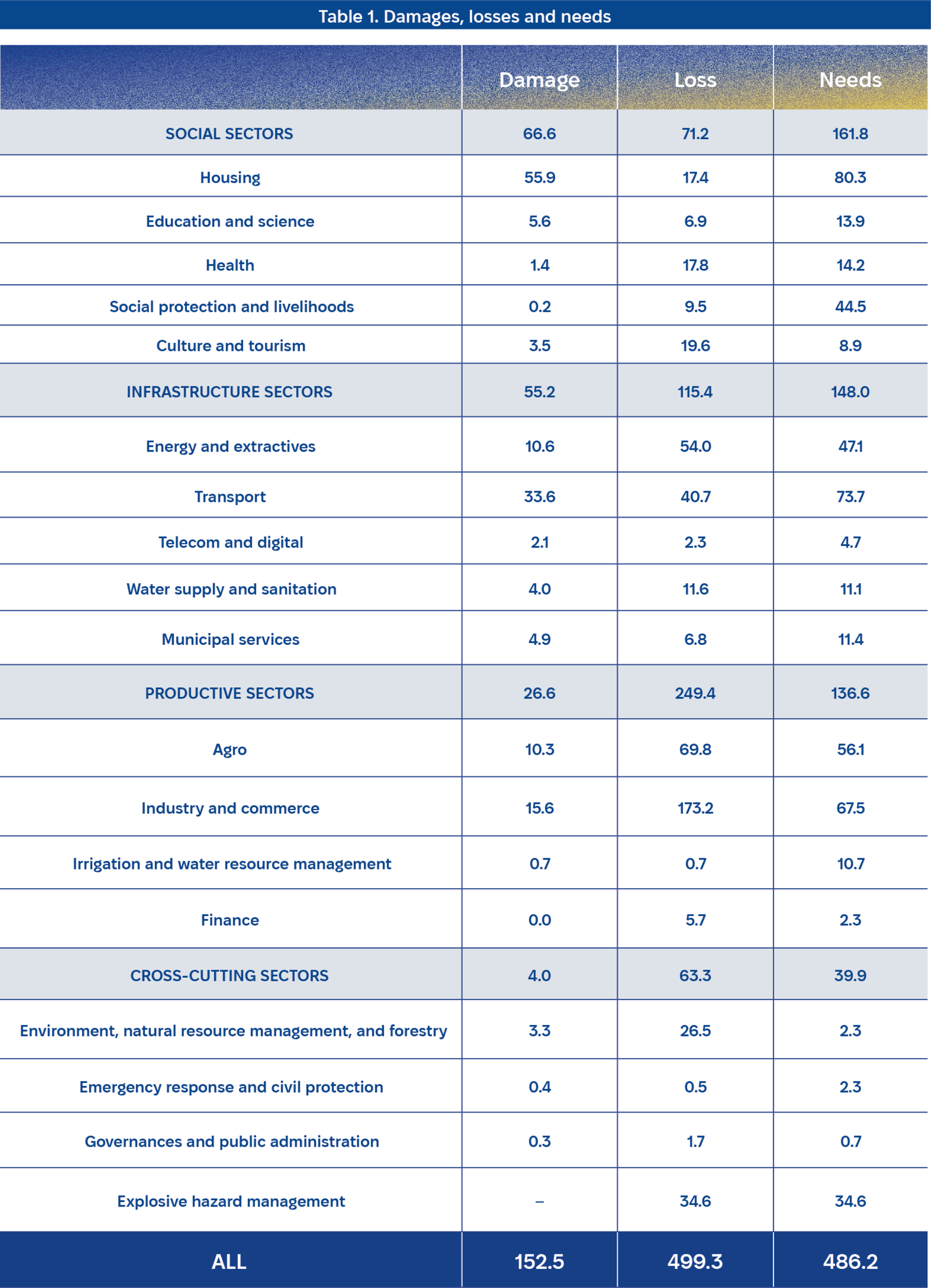

As of early 2024, Ukraine has faced extensive damages due to Russia’s full-scale aggression, with World Bank estimates placing infrastructure and building damage at USD 152.5 billion. Key affected sectors include housing, utilities, transportation, trade, industry, energy, and agriculture, with the most severe destruction in the Donetsk, Kharkiv, Luhansk, Zaporizhzhia, Kherson, and Kyiv regions. Economic losses, including disruptions in economic flows and additional war-related costs like debris removal, are estimated to exceed USD 499 billion.

Reconstruction and recovery present significant challenges and opportunities, estimated at over USD 486 billion. This includes USD 278 billion for reconstruction and USD 208 billion for recovery efforts such as restoring production and services. Major needs are identified in housing (USD 80 billion), transportation infrastructure (USD 74 billion), industry and commerce (USD 67.5 billion), agriculture (USD 56 billion), and energy (USD 47 billion), with energy costs continuing to rise significantly.

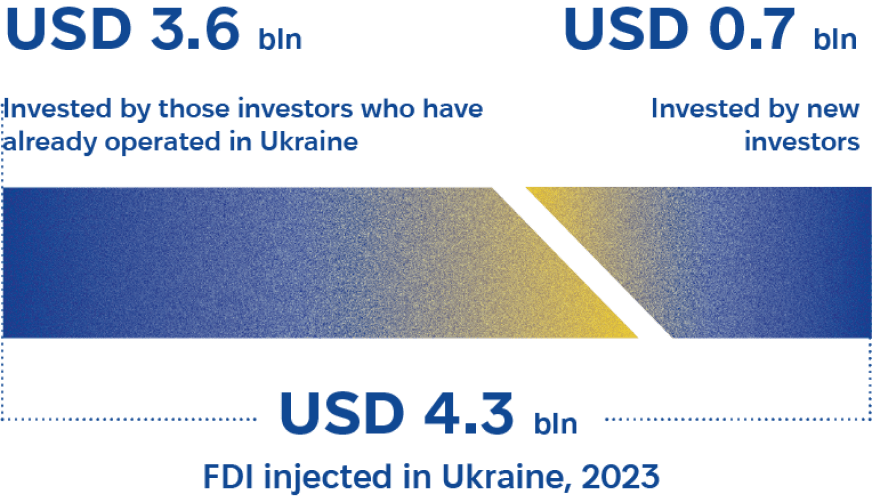

Russia’s aggression initially halted the inflow of foreign investments into Ukraine. However, by 2023, foreign investment began to rebound, with nearly USD 4.3 billion of FDI flowing into the economy. A significant portion of this investment came from foreign entities already present in Ukraine. Additionally, Ukraine experienced a resurgence in attracting new foreign investors, contributing nearly USD 0.7 billion.

This section details Ukraine’s robust strategies across three critical areas — crisis measures, reform programmes, and privatisation prospects — to fortify economic stability and growth amidst challenging conditions.

Initial steps included stabilising the financial system through fixed exchange rates and currency restrictions, crucial for supporting businesses and households during intense geopolitical upheaval. These measures are continuously adapted to foster greater economic resilience.

Supported by significant international financial aid, including the Ukraine Facility programme by the EU, Ukraine is implementing extensive reforms to enhance its business environment and align with EU standards, crucial for leveraging this support to fuel economic recovery and stability.

The strategic optimisation and privatisation of state-owned assets aim to improve governance and attract investments, with a focus on generating substantial revenue and managing resources efficiently to bolster overall economic stability.

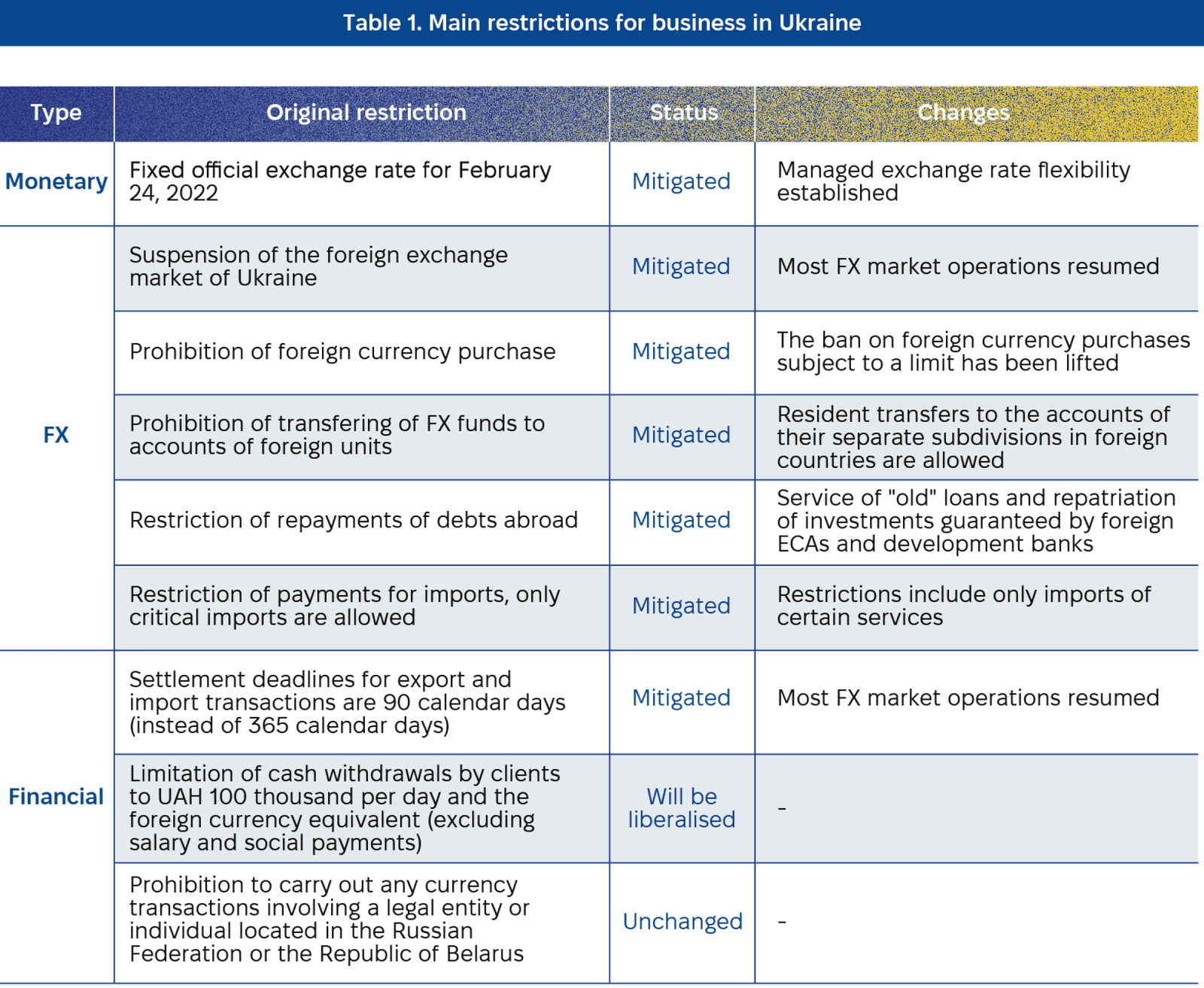

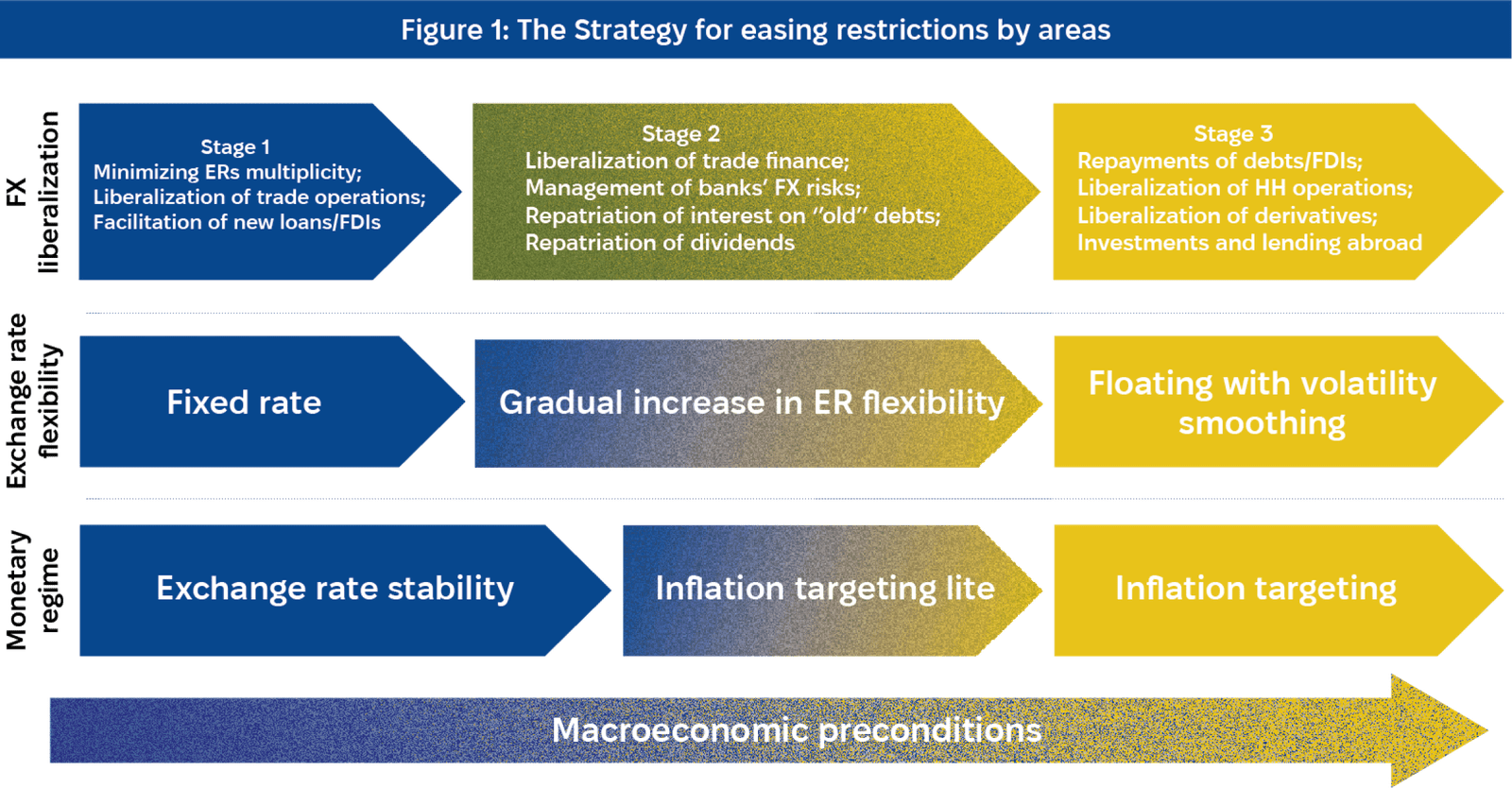

At the onset of the full-scale war, the National Bank of Ukraine (NBU) fixed the hryvnia exchange rate and imposed currency restrictions to stabilise the financial system and support businesses and households. Many restrictions are being lifted or amended as part of the NBU’s strategy to increase exchange rate flexibility and return to inflation targeting, contingent on economic conditions. This includes potentially allowing foreigners to transfer dividends abroad, influenced by inflation, reserve levels, and interest rates. The NBU’s measures align with IMF benchmarks, focusing on minimising exchange rate disparities and enhancing business trade and investment opportunities.

Ukraine has secured significant financial support to sustain its economy, including a USD 15.6 billion IMF Extended Fund Facility and a €50 billion Ukraine Facility programme from the European Union, aimed at budget support and investment in priority sectors.

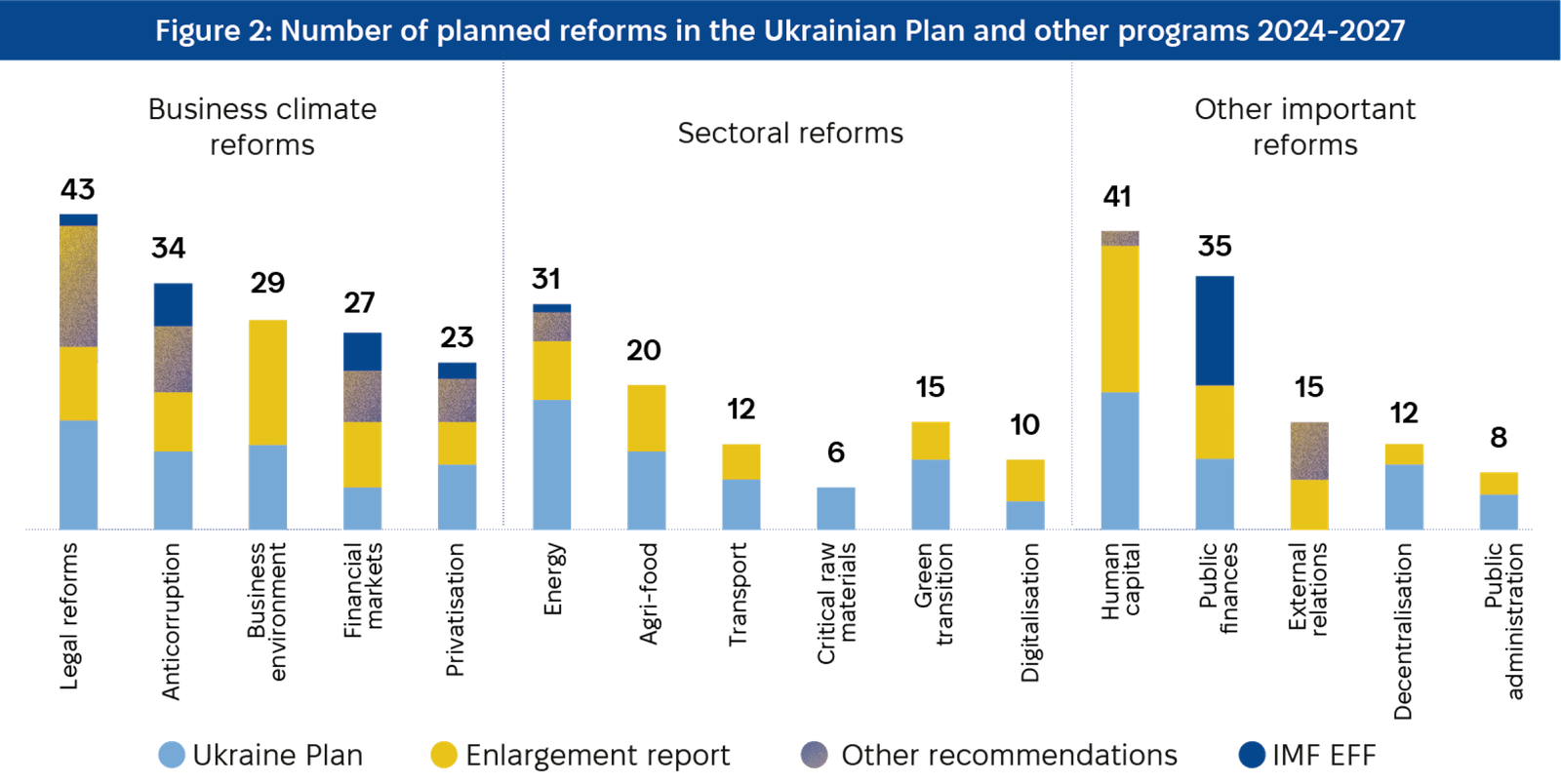

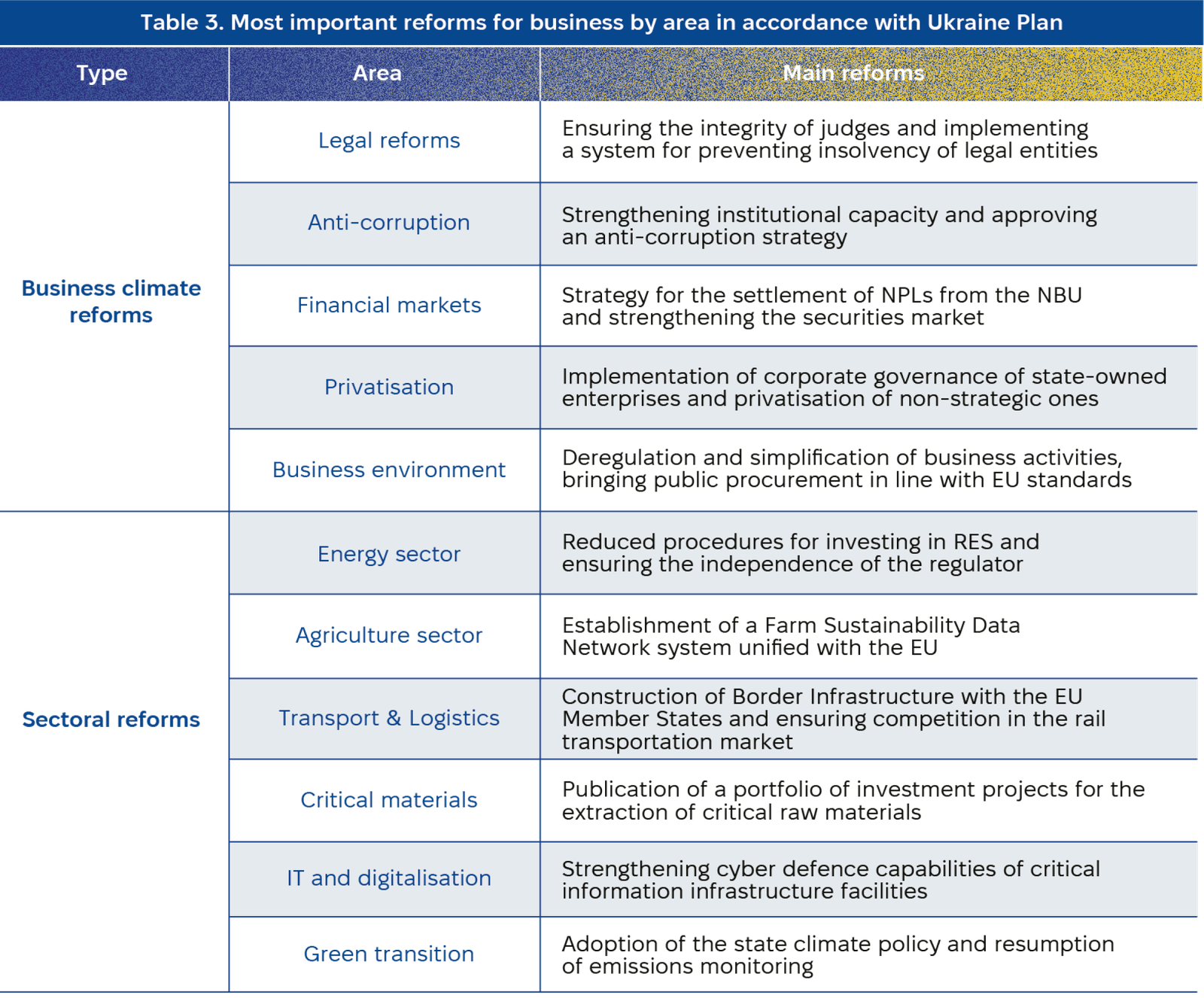

Concurrently, Ukraine is advancing reforms to enhance its business environment and align with EU standards, crucial for accessing full financial support. Key reforms include business deregulation and public procurement alignment with EU standards, with 60% of the planned 156 reforms expected to be implemented by 2024.

As of 2024, Ukraine has streamlined its state-owned enterprises (SoEs) from 3,293 to 1,058, focusing on strategic sectors like energy, infrastructure, and defence. The banking sector also holds over half its assets under state ownership. Concurrently, around 15,000 municipally owned enterprises operate in healthcare and utilities. The goal is to optimise and prepare these assets for privatisation from 2024-2027, enhancing governance in alignment with OECD guidelines.

The State Property Fund (SPFU) is set to sell 19 large-scale and 1,344 smaller assets in 2024, aiming to generate 4 billion UAH from these sales. Additionally, 735 sanctioned assets are prepared for auction, presenting significant investment opportunities. In the realm of land management, the state plans to lease approximately 700,000 hectares, potentially generating up to 7 billion UAH annually through transparent online auctions starting in 2024.

KEY SECTORS

Our sectoral development strategy is focused on key industries that hold both national importance and global potential. By channeling resources and efforts into these areas, we aim to stimulate comprehensive economic development and enhance related industries. These sectors have been selected based on their significant contributions to Ukraine’s economy, global competitiveness, and their high potential for rapid development and attracting investment.

Moreover, Ukraine has the potential to become an EU leader in certain sectors, effectively replacing imports from Russia and China. This strategic focus not only supports domestic growth but also positions Ukraine as a competitive player on the international stage.

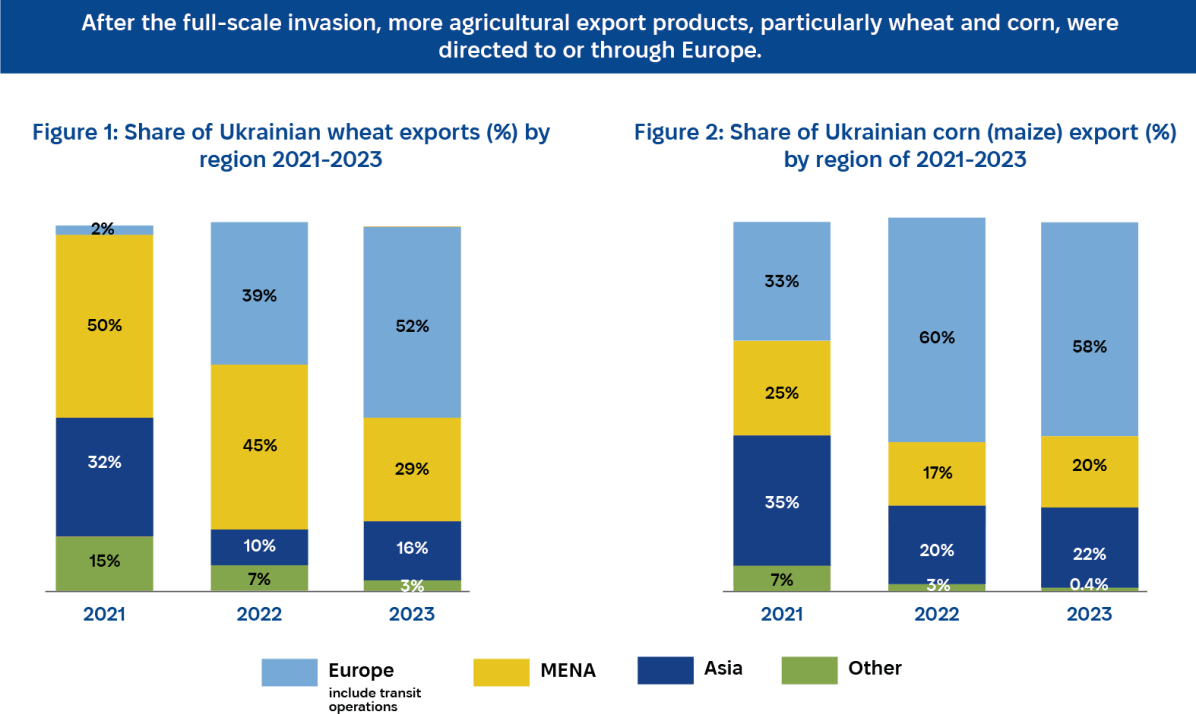

AGRIFOOD

Ukraine’s agrifood sector, with a projected harvest potential of 130-150 million tonnes annually post-conflict, up from 81.6 million tonnes in 2023, plays a crucial role globally, exporting USD 22.1 billion worth of agricultural products in 2023. The country is a leading supplier, accounting for 43% of the world’s sunflower oil, 19% of rapeseed, 13% of corn, and 7% of wheat. Ukraine manages about 26.5 million hectares of highly developed arable land, with ploughing rates significantly exceeding EU averages.

Investment opportunities in this sector are expanding, particularly following the lifting of a long-standing moratorium on private farmland sales, which rejuvenated the market and led to an 18.8% price increase in 2024.

Strategic investments are directed towards restoring damaged assets, focusing on higher value-added products, and bolstering export capabilities. The sector also explores innovations in biofuels and precision agriculture, utilising drones and sensors for efficiency improvements, presenting substantial growth and investment potentials.

TRANSPORTATION AND LOGISTICS

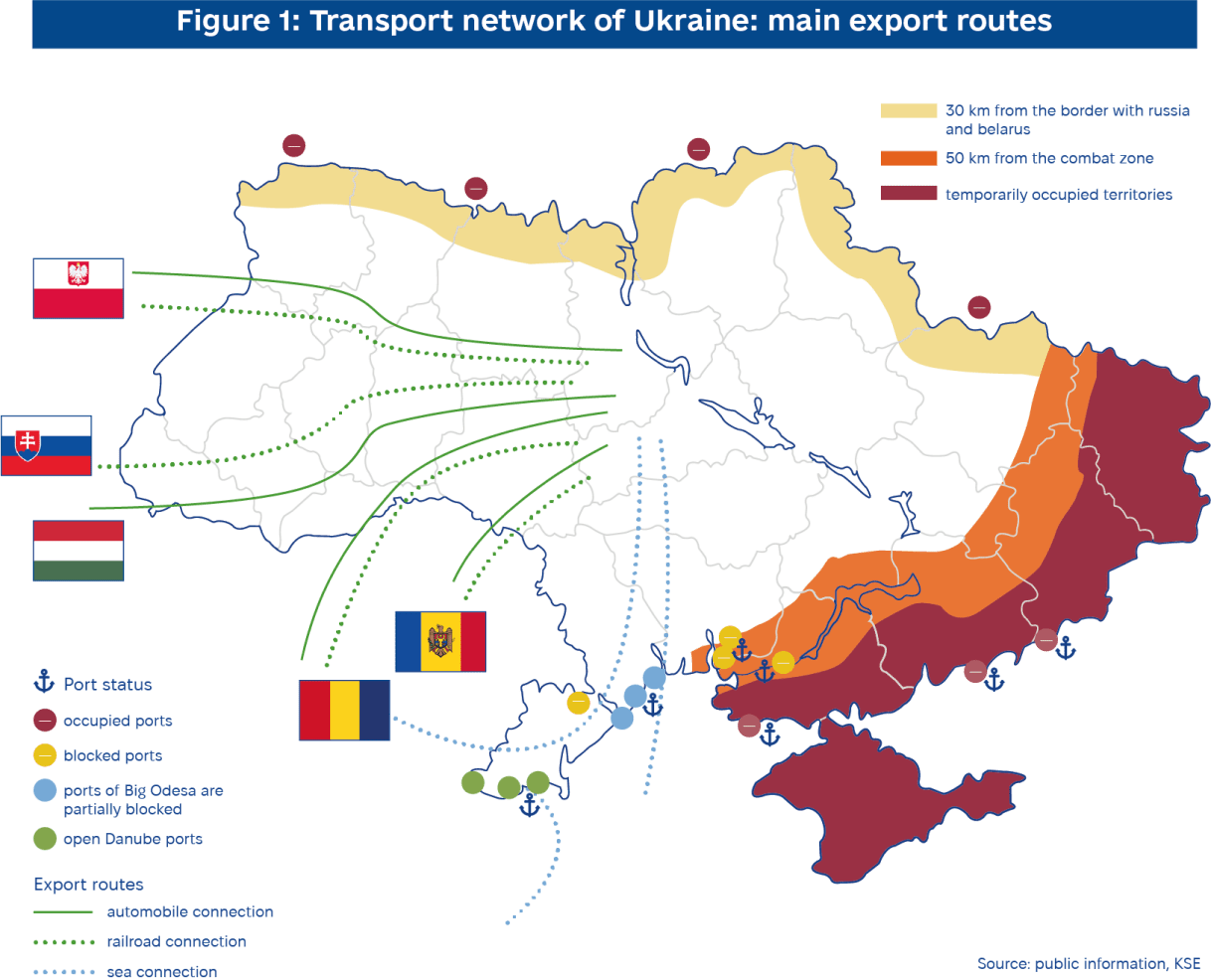

Ukraine’s transport and logistics sector is crucial for its export-driven economy, leveraging its strategic location with access to six neighbouring countries, the Black Sea, and Danube River. Despite facing severe challenges from the ongoing war that resulted in a 28.8% GDP drop and USD 33.6 billion in infrastructure damages, Ukraine plans to invest USD 73.7 billion in recovery and modernisation over the next decade.

War-induced disruptions shifted transport dynamics, notably increasing cargo through Danube ports and impacting rail and maritime capacities. In 2023, rail exports handled 148.4 million tonnes, while road and sea freight also saw significant activity despite declines. Future strategies focus on modernising the logistics infrastructure, integrating with the EU’s TEN-T network, aligning railway standards with the EU, and enhancing port services to bolster Ukraine’s position in global trade.

ENERGY

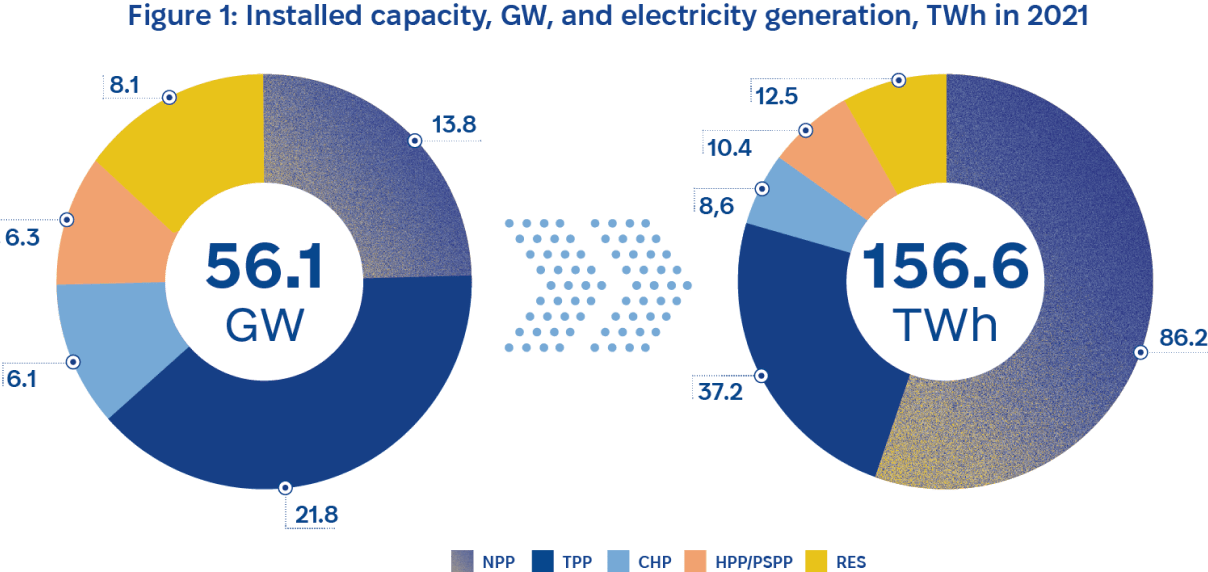

Ukraine holds significant renewable energy potential, previously one of the largest in Europe, with capabilities extending to 874GW, including 250GW from offshore wind. The sector has suffered USD 56.2 billion in damages due to the war, necessitating USD 50.5 billion for reconstruction. Ukraine’s pre-war energy infrastructure included 13.8 GW from nuclear power and substantial capacities in onshore wind, solar, and hydroelectric power.

The nation also possesses vast reserves of natural resources like natural gas and coal, sufficient to meet domestic needs and facilitate exports to the EU.

Future plans include using its large gas storage facilities, building small independent power plants, and manufacturing energy components locally, such as solar panels and energy storage units. These initiatives aim to reduce European reliance on Russian energy and enhance the sustainability and independence of Ukraine’s energy sector.

HYDROGEN

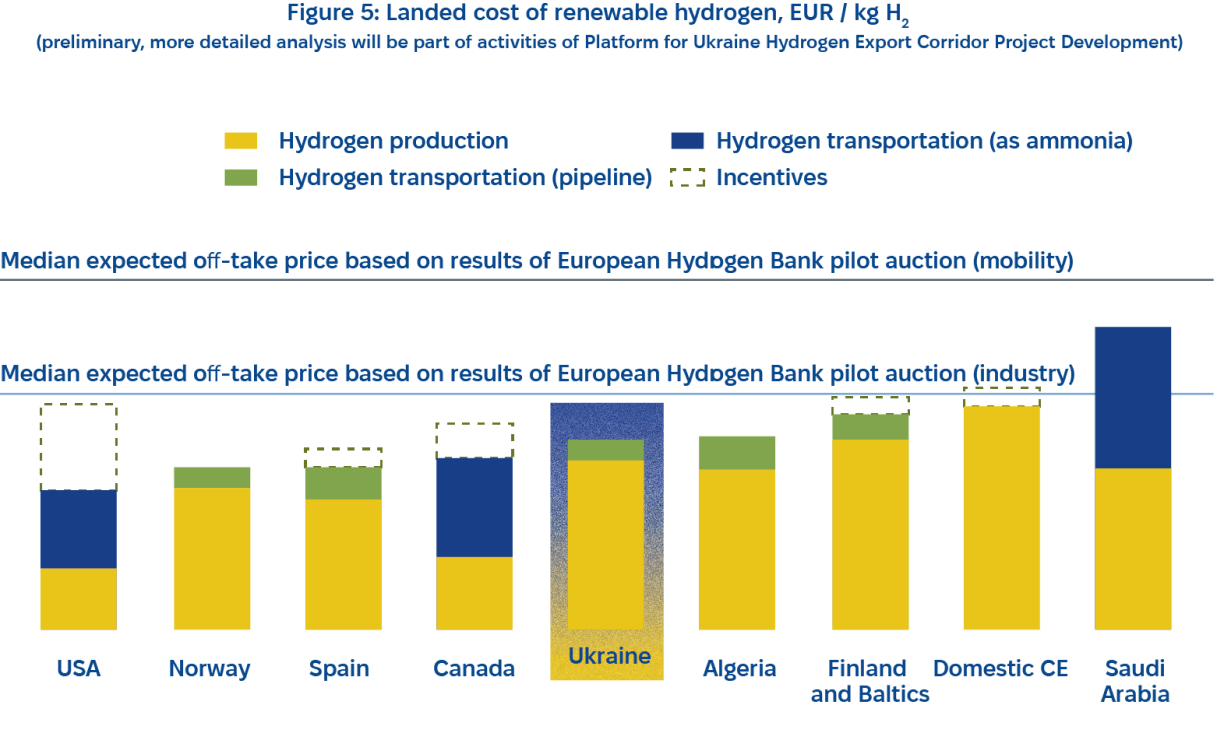

By 2030, the EU targets 10 million tonnes of renewable hydrogen production and imports, with Ukraine as a strategic partner. Ukraine’s abundant renewables, zero-carbon hydro, nuclear capacity, and extensive pipeline network position it to supply Central Europe efficiently. The EU’s Hydrogen Strategy and Ukraine’s plan to produce up to 2.5 Mtpa by 2050 highlight this potential.

Ukraine’s large land mass and low opposition to renewable projects enable large-scale hydrogen production. By 2030, Ukraine could deliver 1.5 million tonnes of hydrogen annually to Central Europe at €5/kg H2. This presents a significant investment opportunity, with potential returns of 10-20% based on Central Europe’s market prices.

GREEN STEEL

Ferrous metallurgy, vital to Ukraine’s economy, was heavily impacted by war, with its contribution to exports dropping significantly. Before the conflict, the sector generated €20.1 billion in 2021, ranking Ukraine among the top global exporters of iron ore and pig iron. However, in 2022, production levels fell sharply: iron ore output decreased by 40%, pig iron by 70%, and finished steel saw a similar decline.

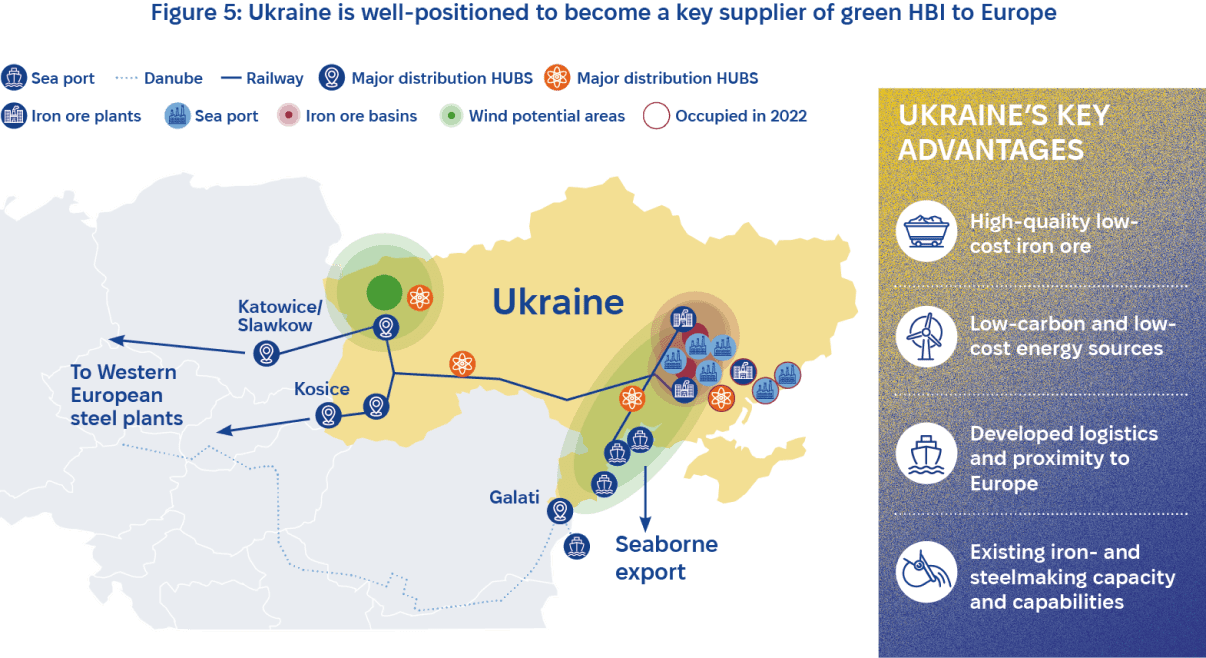

Amid EU efforts to decarbonise steel by 2030, Ukraine is positioned to capitalise on this shift by developing a green iron and steel value chain, thanks to its high-quality iron ore, potential for zero-carbon energy, and proximity to Europe. This aligns with the EU’s rising CO2 pricing and stricter emissions policies, making Ukraine a potential key supplier of Hot Briquetted Iron (HBI) to Europe.

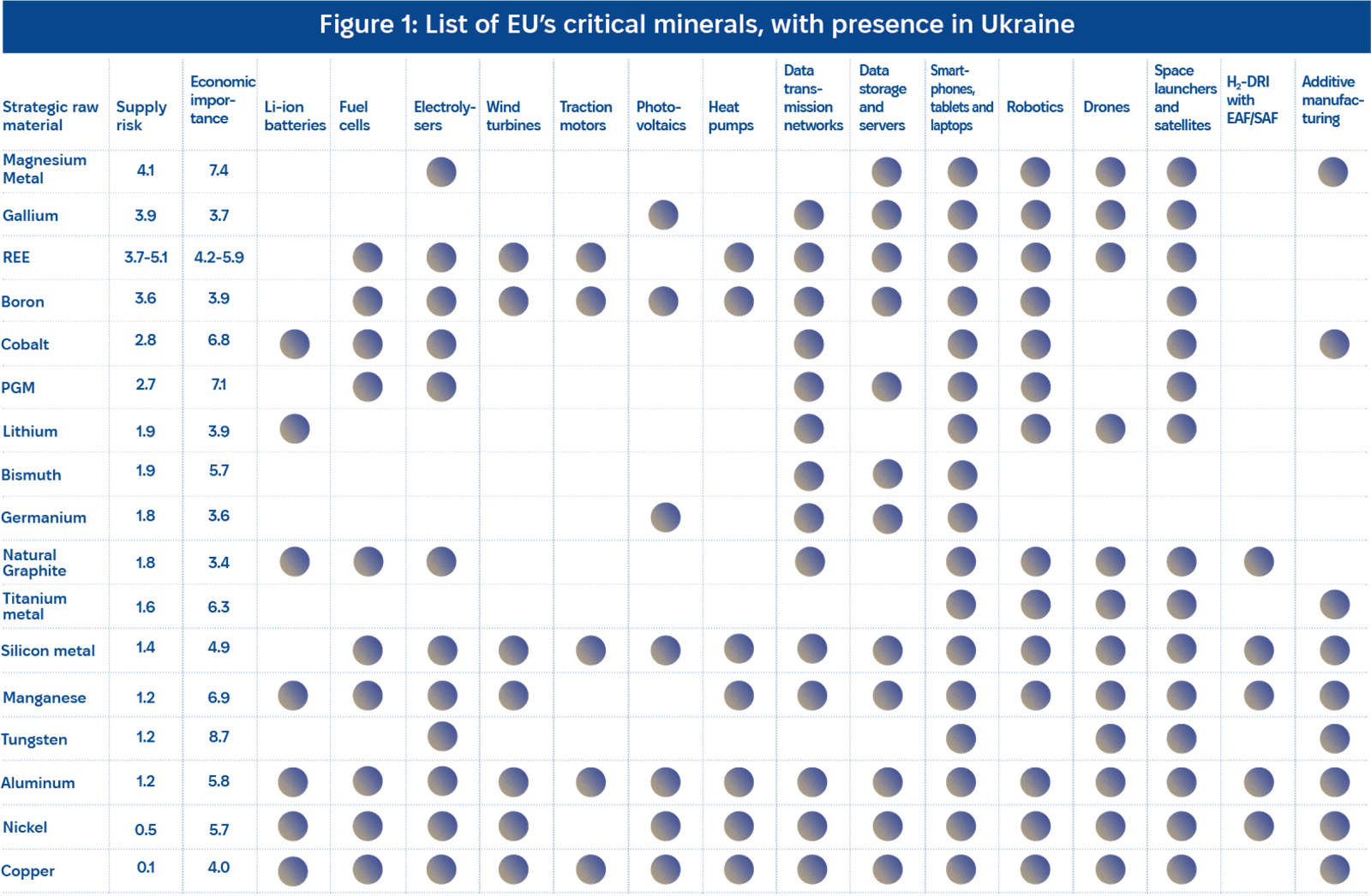

CRITICAL RAW MATERIALS

Ukraine is rich in critical raw materials (CRMs) essential for green energy and technology, holding deposits of 22 of the EU’s 34 identified critical minerals. This positions Ukraine as a strategic alternative to reliance on China and Russia. A 2021 Memorandum of Understanding with the EU aims to integrate these materials into European battery value chains and explore a titanium partnership with the US.

With a robust mining ecosystem that pre-war generated over 6% of its GDP and a strong technical base, Ukraine was one of the world’s top 10 CRM producers. This expertise can propel Ukraine into key roles in the EV and battery sectors, aligning with European efforts to diversify CRM supplies. Ukraine’s resources in lithium, graphite, and titanium are set to enhance its integration into global value chains, supporting European CRM security.

HOUSING, RECONSTRUCTION AND BUILDING MATERIALS

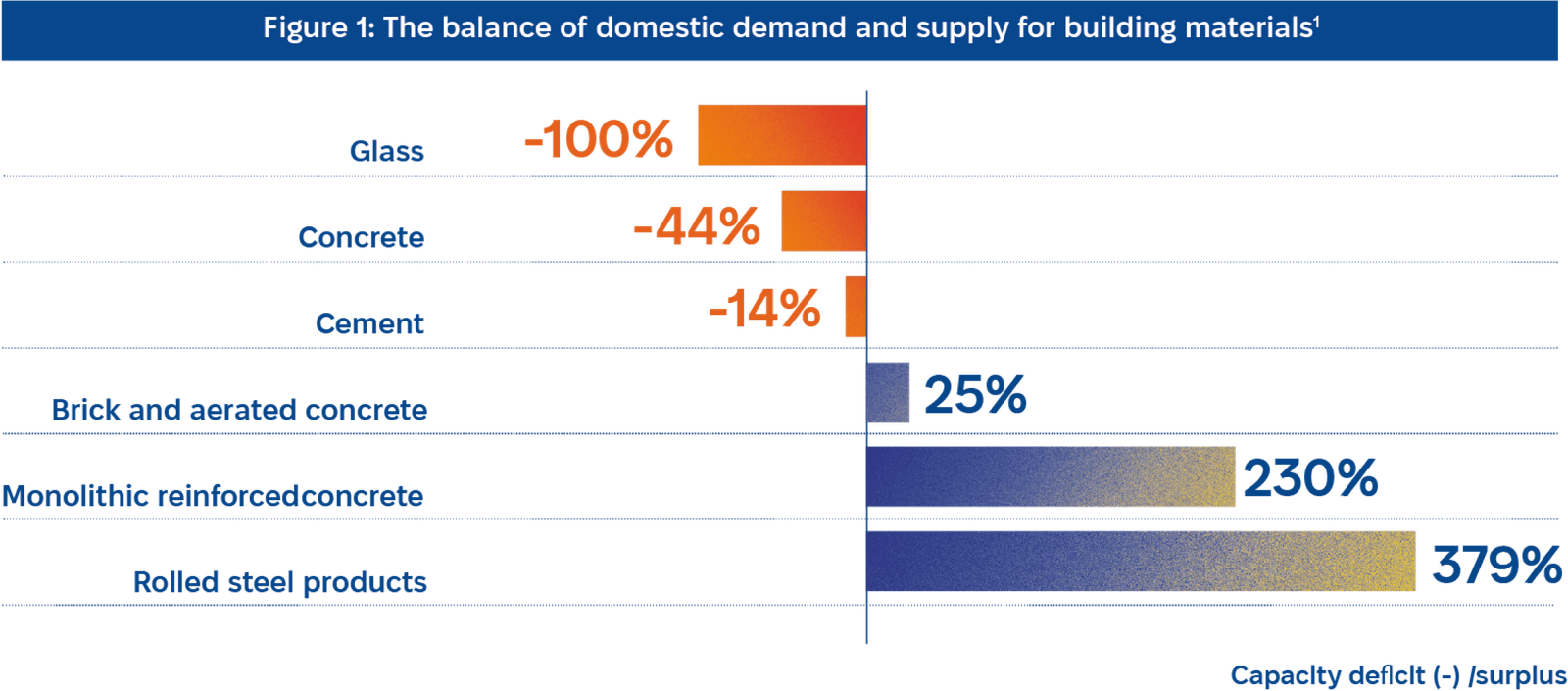

Ukraine faces significant reconstruction needs, with housing recovery estimated at USD 80.3 billion over 2024-2033, as over 10% of housing stock, affecting nearly 2 million households, has been damaged or destroyed. The sector’s total needs, including water supply and sanitation, amount to USD 22.5 billion due to extensive wartime damage. The reconstruction effort extends to municipal services, requiring an additional USD 11.4 billion.

In the construction sector, projected post-war volumes are expected to exceed the pre-war figure of USD 6.6 billion, despite material shortages in glass, PVC, cement, and concrete. Local production can meet most demands, offering investment returns in undersupplied areas. The government, continuing reconstruction amid military operations, plans to prioritize local materials to limit imports, positioning itself as the main market consumer in the coming years.

PHARMACEUTICAL AND MEDICAL SECTORS

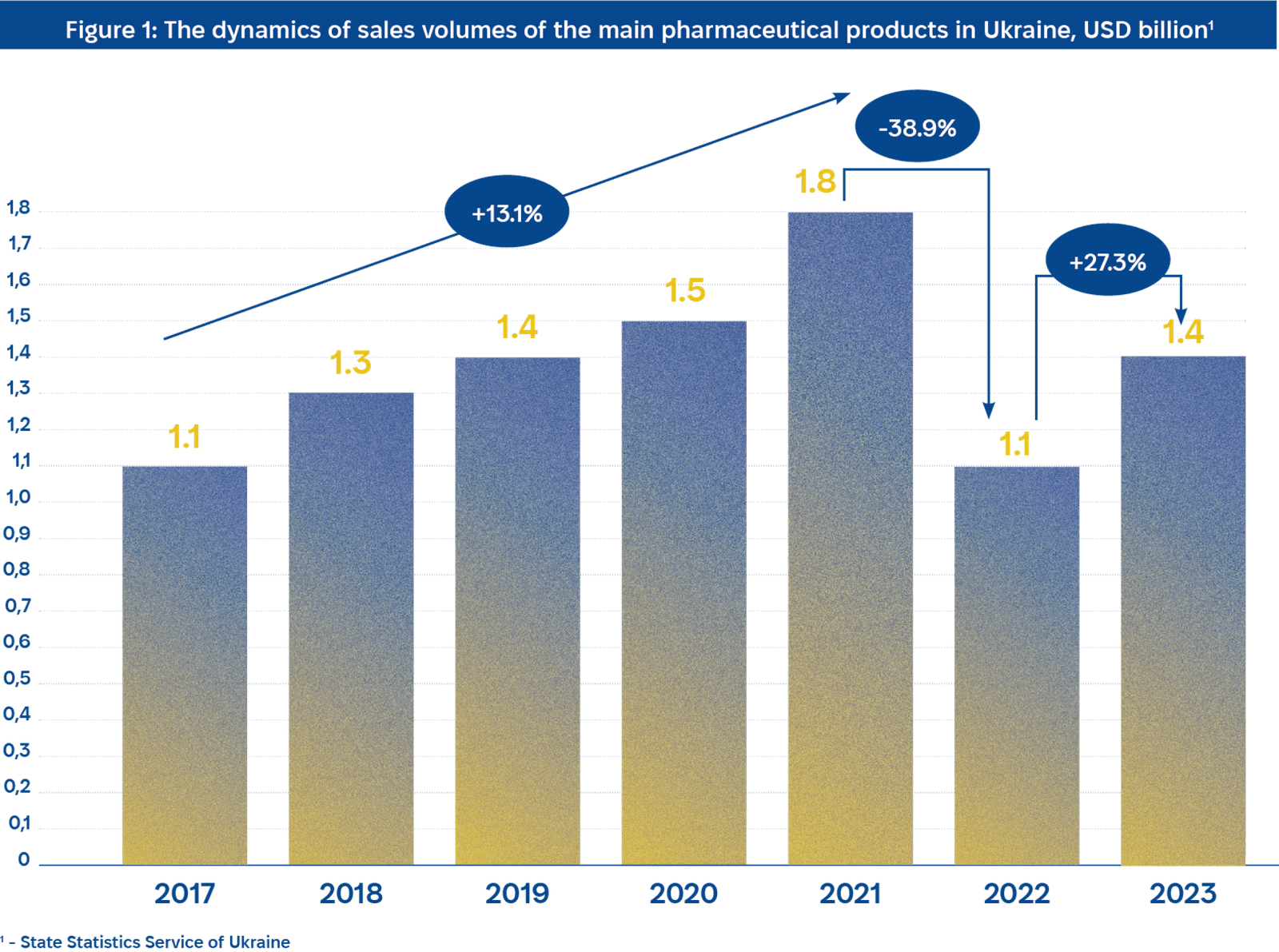

From 2016 to 2021, Ukraine’s pharmaceutical GDP grew from USD 0.8 billion to USD 1.8 billion, but faced a decline in 2022. Recovery in 2023 saw a 27.3% increase in production to USD 1.4 billion, despite a 24.3% drop in exports and a 38.7% decrease in imports the previous year.

The invasion severely impacted Ukraine’s medical infrastructure, damaging 1,389 and destroying 186 medical facilities by mid-2023. Restoration efforts have been significant, with 343 facilities fully restored and another 414 partially repaired by July 2023. Future growth in the pharmaceutical sector is anticipated through aligning Ukrainian legislation with EU standards and fostering partnerships with international entities, enhancing competitiveness and market presence.

ICT AND DIGITAL SECTOR

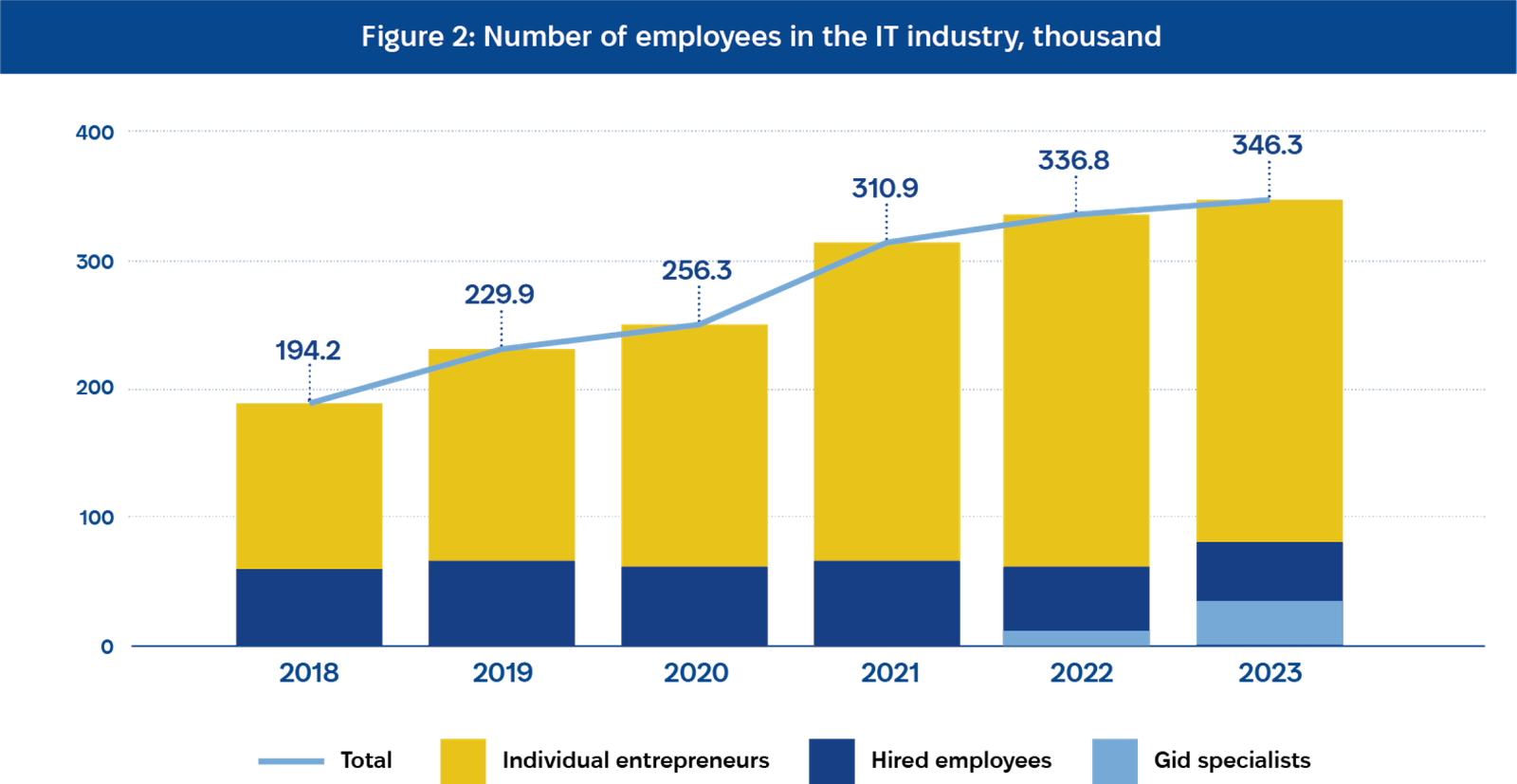

Despite the full-scale invasion, Ukraine’s ICT sector stood out by increasing its exports to over USD 6 billion in 2022, despite facing direct damages and recovery needs totalling more than USD 9 billion by the end of 2023. The sector, supported by government policies such as non-drafting IT workers and providing tax breaks, continued exporting services even as many companies relocated.

From 2015 to 2023, Ukraine’s ICT industry more than doubled, contributing 4% to the GDP (USD 6.7 billion) and generating nearly USD 1 billion in taxes in 2023. IT services exports grew by 196% between 2017 and 2022, reflecting strong global competitiveness. In 2023, top communications companies invested USD 444 million, with total infrastructure investments reaching USD 516 million. Despite challenges, 74% of companies reported stable or increased income in 2023, underscoring the sector’s resilience and economic impact.

PRACTICAL INFORMATION AND KEY DATA FOR INVESTORS

Essential information for foreign investors on navigating Ukraine’s business environment. It includes the entry regime for foreign citizens, guidelines for setting up business operations, and detailed insights into investments and taxation. Topics covered range from investment activity restrictions, implications of martial law, sanctions, and capital controls, to land ownership regulations. An overview of Ukraine’s business tax framework is also provided to support effective investment and operational planning.

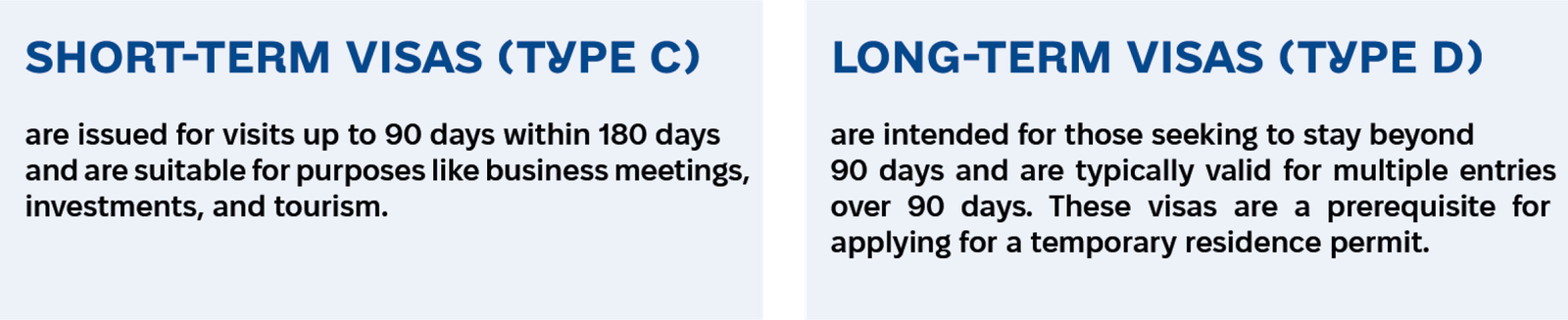

The entry regime for foreign citizens in Ukraine offers unique opportunities for outside investors to participate in the economy. Foreign nationals legally residing in Ukraine generally enjoy the same rights as Ukrainian citizens, except for certain political rights, such as voting. Those planning to visit or conduct business in Ukraine should check visa requirements applicable to their situation. Ukrainian visas are categorised as follows:

It is noted that foreign citizens of selected countries benefit from visa-free entry in relation to private, short-term travel i.e., they do not require a visa for travel to Ukraine for up to 90 days every 180 days. The full list of countries that entitle their citizens to short-term visa-free entry can be found at the Ministry of Foreign Affairs.

For long-term stays, foreign nationals must obtain a temporary residence permit, which is necessary for pursuits such as education and employment. Those seeking long-term visas or temporary residence permits should obtain specialised advice and prepare thoroughly to meet all immigration requirements. For information on obtaining a foreign residence permit, visit the State Migration Service of Ukraine.

Investors interested in formalising their business operations in Ukraine have multiple setup options. They can choose from a wide range of legal entities such as Limited Liability Companies (LLCs) or Joint-Stock Companies. Alternatively, they can conduct activities through representative offices.

The LLC is the most prevalent business form in Ukraine due to its flexibility and cost-efficiency. An LLC can be established by individuals or legal entities, either foreign or Ukrainian, with no maximum limit on the number of founders. There is no required minimum share capital; however, founders must fully pay the initial capital within six months of registration. Registration typically takes one business day, is free of charge, and can be completed through a power of attorney.

Opening a representative office is another common practice among foreign investors. A representative office is a division of a foreign company and not a separate legal entity. It is managed by a head appointed by the foreign company and must register as a permanent establishment for commercial activities. Although registration takes longer and is less regulated than an LLC, it offers certain tax advantages, such as including expenses directly in the foreign company’s costs.

Foreign investments in Ukraine encompass a wide range of activities. Businesses from abroad looking to enter the Ukrainian market have several options, including establishing a local presence by creating a new legal entity, acquiring shares, engaging in asset deals, or forming agreements with local partners.

Many of the restrictions affecting foreign investors in Ukraine arise due to the ongoing war. Consequently, special measures such as the martial law regime, sanctions, and capital controls have been implemented to facilitate the smooth operation of the wartime economy, in alignment with national interest. These restrictions are horizontal, meaning they apply uniformly to all investors regardless of nationality.

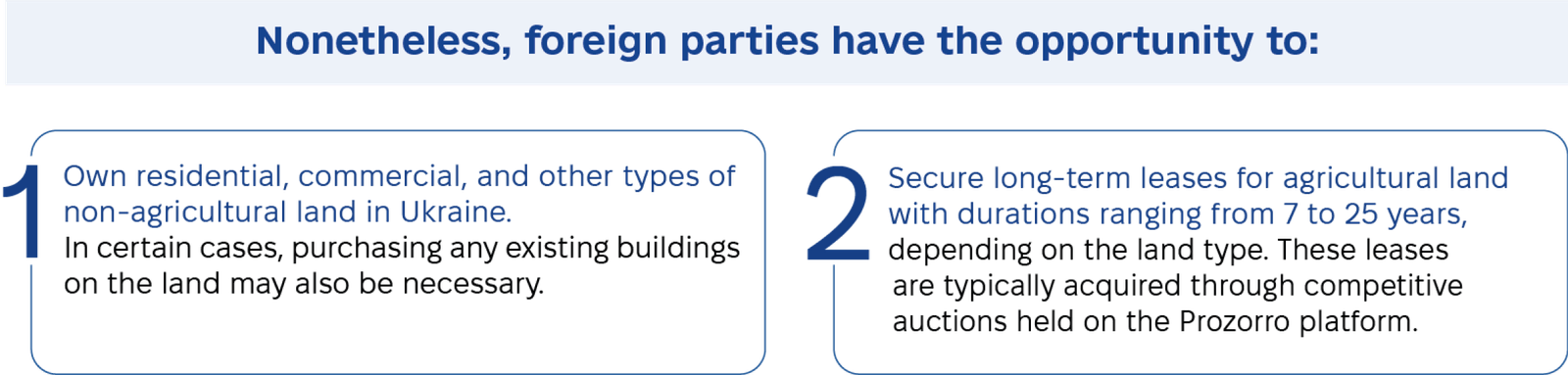

Additionally, foreign investors should be aware of other key restrictions, such as the regulatory and licensing requirements that govern certain economic activities and the restrictions on land ownership.

Foreign investors conducting business in Ukraine are required to adhere to the regulations of the martial law regime, which mandates specific adjustments to business operations during wartime. Key adjustments include:

- Obligation to comply with local curfew laws and follow security protocols in case of emergency alerts, to ensure the safety of their employees and stakeholders.

- Introduction of mobilisation rules, according to which

- Ukrainian employees can be summoned for army service.

- Companies engaged in ‘critical’ economic activities may be able to retain a certain percentage of their workforce exempt from mobilisation.

- Various restrictions on international trade e.g., reduced period of export-import settlements and restrictions on financial transactions.

The National Security and Defence Council of Ukraine has the authority to impose sanctions on foreign states, legal entities, and individuals. These sanctions may be based on activities that threaten national interests, security, sovereignty, and territorial integrity, or those that support terrorism or violate human rights.

As a direct consequence, any legal entities or individuals sanctioned by Ukraine are prohibited from investing in Ukrainian companies and are not allowed to withdraw their investment and/or repatriate their capital.

It is imperative for foreign investors active in Ukraine to conduct thorough due diligence on their stakeholders by consulting the State Sanctions Registry. Engaging with sanctioned parties could lead to significant operational risks. For instance, contracts may be invalidated for violating public order, or payments might be disrupted due to the freezing of assets.

In response to the challenges posed by the full-scale war, the National Bank of Ukraine (NBU) has implemented stringent controls on foreign currency (FX) transactions to stabilise the financial system and prevent uncontrolled capital outflows.

Prospective investors are strongly encouraged to follow the site of the National Bank of Ukraine, as it regularly publishes updates on easing of FX restrictions.

Foreign citizens and legal entities—including Ukrainian legal entities with foreign shareholders—are currently prohibited from owning agricultural land plots in Ukraine.

Recent reforms have expanded land ownership rights for Ukrainian nationals and local entities, allowing them to own up to 10,000 hectares, a significant increase from the previous limit of 100 hectares, effective from 1 January 2024. However, this privilege does not extend to foreign investors.

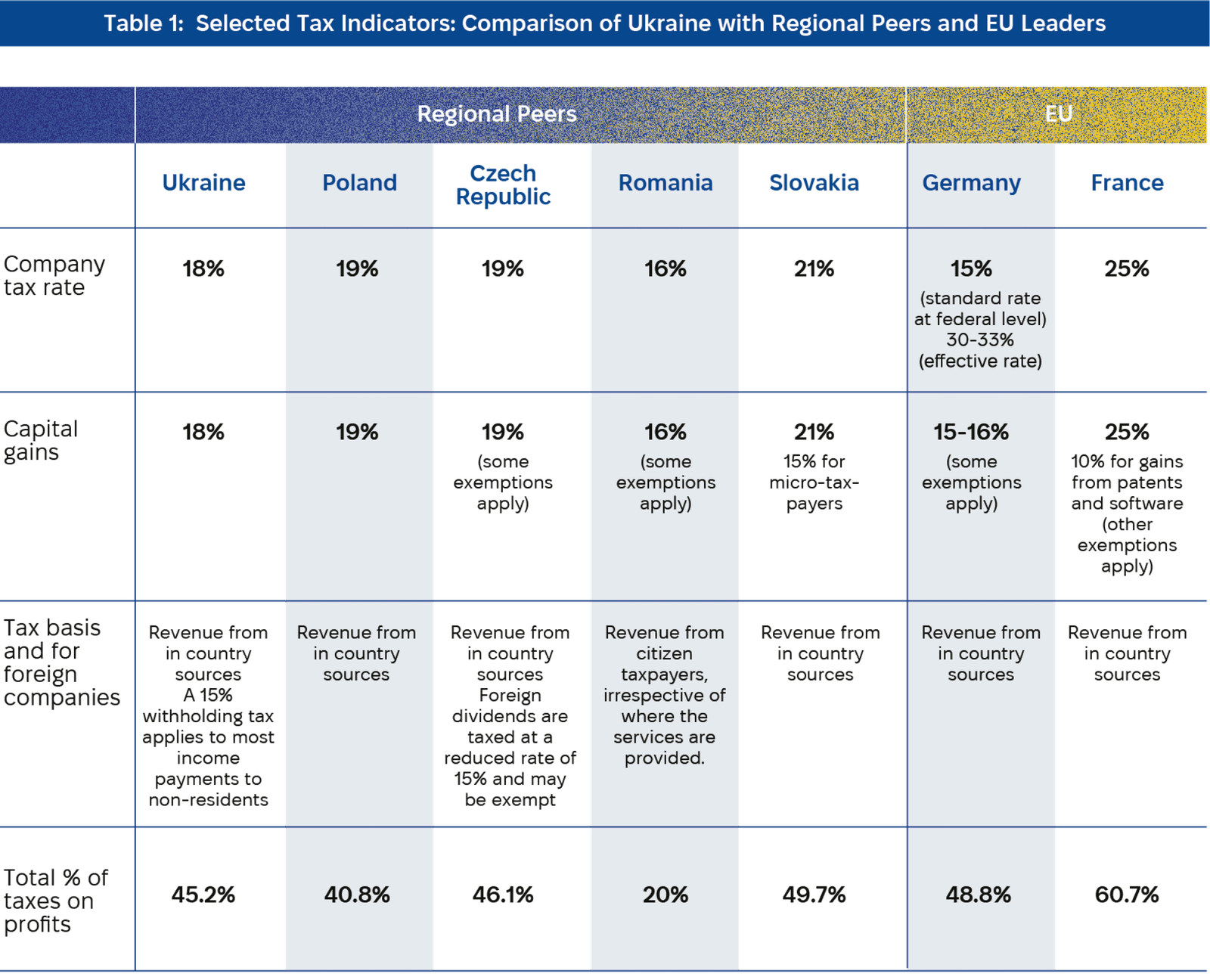

Business entities in Ukraine are required to pay corporate income tax on their worldwide profits at a rate of 18%, which is relatively low compared to regional peers. This rate also applies uniformly to capital gains, which are classified as ordinary income. For a comparative overview of Ukraine’s corporate tax rate with its regional peers and EU leaders, refer to Table 1: Selected Tax Indicators: Comparison of Ukraine with Regional Peers and EU Leaders.

In Ukraine, most corporate expenses are deductible, including organisational and start-up costs, interest payments, social security contributions, and research and development (R&D) expenses. Additionally, deductions are available for selected charitable donations, which may vary based on the recipient, such as the Ukrainian armed forces, or the type of goods and services donated, like personal protective equipment and medical devices.

Foreign companies operating in Ukraine are taxed on all locally sourced revenue and are subject to a 15% withholding tax on most income payments. However, lower rates may apply if there is a tax treaty between Ukraine and the company’s country of tax residence that aims to avoid double taxation.

Employers are responsible for withholding personal income tax at 18% and a military duty at 1.5% from salaries. They must also contribute a unified social security payment at a rate of 22% of the payroll cost. For employees in Diia.City (see Section 6.5.3 below), lower rates may apply.

Companies operating in Ukraine may also be liable for additional taxes, including local real estate taxes, state duties, and environmental taxes. Note that these taxes can vary significantly between different regions and municipalities.

FOR COMPANIES:

Showcase your best projects to investors and strategic partners.

FOR INVESTORS:

Discover high-potential investment opportunities now.

Access all materials and documents on Ukraine’s economy in our Digital Library.