FINANCING INSTRUMENTS

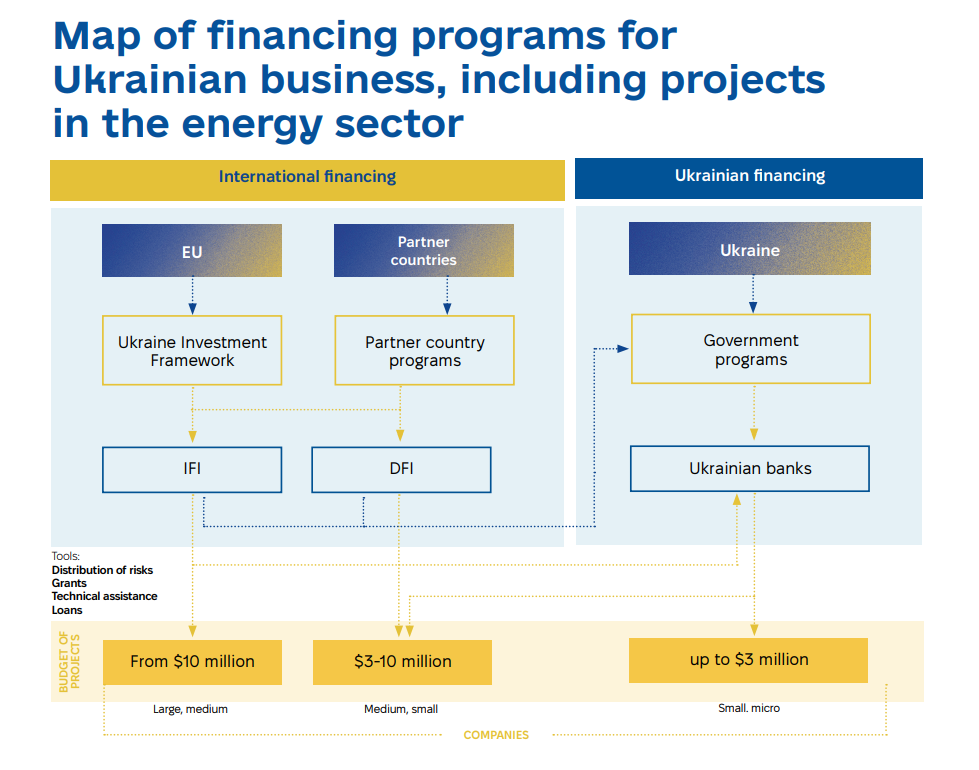

This page offers practical guidance on securing funding, including government support programmes like Affordable Loans 5-7-9, grants, and financing opportunities from international financial institutions and partner countries. You will find comprehensive information on key international financial institutions (IFIs) and development financial institutions (DFIs), how to collaborate with them, and valuable tips for entrepreneurs on preparing and submitting projects for funding.

-

Ukraine Investment Framework

Ukraine Investment Framework (UIF), part of the Ukraine Facility programme of the European Union, plays a critical role in mobilizing investments for the reconstruction and modernization of Ukraine. With an overall budget of €9.3 billion, UIF supports economic recovery and addresses key post-war challenges.

UIF is designed to enhance the investment climate, strengthen infrastructure, and promote the growth of small and medium-sized enterprises (SMEs). At the Ukraine Recovery Conference 2024, the first phase of the UIF was launched, focusing on expanding existing programmes from IFIs and DFIs (EBRD, IFC, EIB, KfW, and BGK) to ensure quicker access to financing for Ukrainian businesses.

The programmes of Ukraine Investment Framework offer a range of financial tools, including concessional financing for liquidity, growth, and exports. Combined with Ukraine’s 5-7-9 affordable loan programme, these instruments help businesses access favourable financing, supporting a stronger, more resilient economy.

The next phase of the UIF will introduce new financing tools for projects in Ukraine, such as private equity funds, capital market instruments, public investment financing, and crowdfunding platforms. It will also expand guarantees for large investments and innovative projects, focusing on supporting Ukrainian exports and improving the investment climate through education and advisory programmes.

-

Available Instruments

This section outlines key financial instruments under the Ukraine Investment Framework, including investment loans supported by guarantees and grants, blended finance for socially impactful projects, and consulting services for business growth. Export and project finance are also available for larger investments.

Insurance tools, such as war and political risk insurance, help businesses protect assets and reduce financial losses in high-risk environments. These instruments support Ukraine’s economic recovery and development in challenging conditions.

Main financing instruments

Lending: Primary financing method for businesses, covering working capital and investments like expansion and equipment. UIF focuses on investment loans, made more accessible through guarantees, grants, blended finance, and technical support.

Guarantees: Mitigate risk for banks in case of loan defaults

- Individual: Help companies secure loans on favourable terms

- Portfolio: Reduce loan portfolio risks, especially for MSMEs.

Grants: Non-repayable aid for MSMEs, supporting innovation, exports, environmental projects, and infrastructure.

Blended finance: Combines commercial and concessional financing for socially or environmentally impactful projects.

Consulting and Technical Assistance: Provides advice to businesses on adopting technologies, enhancing skills, and improving management.

Project finance: For large-scale investment projects, funded by the project’s future revenues.

Export finance: Supports international trade through export loans and risk insurance.

War risk insurance

War risk insurance is a critical tool for businesses to protect their assets and reduce financial losses caused by military operations. In Ukraine, this insurance specifically helps companies safeguard against the devastating impacts of the ongoing war, ensuring financial stability.

Political Violence Insurance: Covers losses from war, terrorism, and political violence, crucial for businesses in politically unstable environments.

Political Risk Insurance: safeguards investors from financial losses due to war, nationalization, political instability, or sanctions, making it essential for attracting foreign investors to high-risk regions.

Default Risk Insurance: safeguards against financial defaults caused by war or force majeure in high-risk regions.

Property War Risks Insurance: insures property, including buildings, equipment, and inventory, against damage or destruction from war risks, applicable to all business sectors.

Cargo War Risk Insurance: protects cargo from damage or loss during transport as a result of military operations.

-

International Financial Institutions (IFIs)

International financial institutions (IFIs) are supranational organizations that provide financial support to promote economic development, stability, and international cooperation. They offer loans, grants, and technical assistance to member countries, funding projects in areas such as infrastructure, poverty reduction, and sustainable growth. Major IFIs include the IMF, World Bank, EBRD, EIB, and IFC.

Under Phase 1 of the Ukraine Investment Framework, five IFIs have received EU funding to finance projects in Ukraine. These institutions either fund large-scale projects directly or work through the Ukrainian banking sector to provide broader financial support.

In the Practical Guide, we offer a detailed overview of the support programmes available from IFIs under the first phase of the Ukraine Investment Framework, including EIB, EBRD, IFC, KfW, and BGK. The Guide also outlines the requirements for potential participants in these programmes.

-

Development Financial Institutions (DFIs)

Development Financial Institutions (DFIs) provide financial support and investments to promote economic growth in developing countries. As government agencies, they offer long-term financing for projects that drive job creation and infrastructure development. DFIs operating in Ukraine include KfW (Germany), Swedfund (Sweden), IFU (Denmark), and Proparco (France), with DFC (USA) planning to establish an office.

DFIs finance projects with budgets ranging from $5 to $15 million in both the private and public sectors. They offer a variety of financial instruments, such as loans, equity investments, guarantees, and technical assistance, helping to implement projects aimed at economic development and infrastructure improvement.

-

Ukrainian Banks

The banking sector is a cornerstone of Ukraine’s financial system, with bank assets accounting for nearly 90% of all financial sector assets (excluding the NBU). As of 1 July 2024, Ukraine had 62 operating banks, including 6 state-owned, 14 foreign, and 42 Ukrainian private banks. International financial institutions (IFIs) are currently implementing programmes through over 15 partner banks in Ukraine, with this list continually growing.

Banks are selected for cooperation with IFIs based on key criteria such as financial stability, adherence to international risk management standards, capacity to work with small and medium-sized enterprises (SMEs), and commitment to high standards of transparency and corporate governance. Collectively, these banks operate around 3,200 branches across the country, enabling them to effectively finance and support business development in all regions of Ukraine.

-

Insurance Programmes

In the context of a full-scale war, maintaining a steady flow of investment into the Ukrainian economy and businesses is crucial. However, this cannot be achieved without proper war risk insurance and guarantees for investors. The launch of military and political risk insurance in Ukraine is, therefore, a significant milestone for both the insurance market and the broader economy.

A well-developed war risk insurance infrastructure serves as a vital incentive for investors, enabling them to enter the Ukrainian market with confidence. This will lead to the creation of new jobs and the expansion of production capacities, particularly for export. Currently, several mechanisms for insuring against military and political risks are available in Ukraine, provided by various stakeholders.

By enhancing and broadening these insurance tools, Ukrainian and foreign companies can gain greater financial security, boosting business activity. This insurance will help establish the facilities and infrastructure necessary to develop Ukraine’s processing industry and expand the export of locally manufactured goods.

Practical Handbook with comprehensive overview of available instruments for financing businesses in Ukraine. Programs by IFIs, DFIs, Ukrainian Banks, and Insurance Companies

Access all materials and documents on Ukraine’s economy in our Digital Library.