Ukraine Investment Project Portal — a matchmaking platform that connects investors and Ukrainian entrepreneurs in need of investment, and provides analytics from the KSE Institute for data-driven decisions.

Get a look at the projects presented on the site by using the search

ID

Project name

Sector

Required financing, USD mln

Total budget, USD mln

% Financed

Nothing was found

Loading

| ID |

Project name

|

Sector

|

Required financing, USD mln

|

Total budget, USD mln

|

% Financed

|

|---|---|---|---|---|---|

|

|

Project's Highlights

Expected Financial Indicators

Form for Expressing Interest in a Project

Thank you for your interest in our featured projects. By completing this form, you enable us to connect you with the project leaders and provide further information about the project you are interested in. Your request will be processed, and a representative will reach out to you to discuss the next steps.

Please use the list of trusted companies that provide consulting, legal, and financial services and offer support to get specialized advice on your question

The digital library provides access to the latest research by KSE Institute experts about the current state of the economy and its specific sectors, investment attraction, financing, business climate, and human capital. It also offers practical guides for investors and entrepreneurs looking for financing.

A practical guide to financing business in Ukraine – explore funding programs from IFIs, DFIs, banks, and insurers

PRACTICAL INFORMATION AND KEY DATA FOR INVESTORS

Essential information for foreign investors on navigating Ukraine’s business environment. It includes the entry regime for foreign citizens, guidelines for setting up business operations, and detailed insights into investments and taxation. Topics covered range from investment activity restrictions, implications of martial law, sanctions, and capital controls, to land ownership regulations. An overview of Ukraine’s business tax framework is also provided to support effective investment and operational planning.

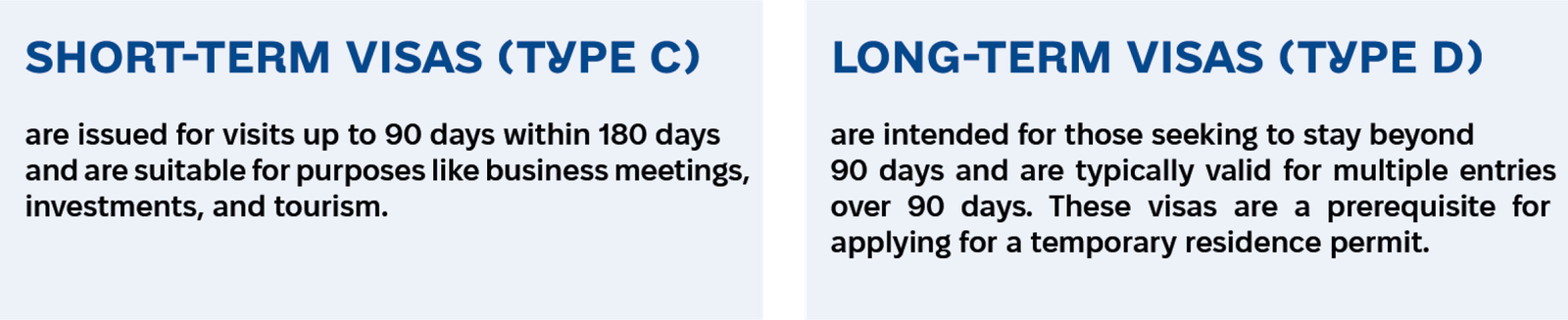

The entry regime for foreign citizens in Ukraine offers unique opportunities for outside investors to participate in the economy. Foreign nationals legally residing in Ukraine generally enjoy the same rights as Ukrainian citizens, except for certain political rights, such as voting. Those planning to visit or conduct business in Ukraine should check visa requirements applicable to their situation. Ukrainian visas are categorised as follows:

It is noted that foreign citizens of selected countries benefit from visa-free entry in relation to private, short-term travel i.e., they do not require a visa for travel to Ukraine for up to 90 days every 180 days. The full list of countries that entitle their citizens to short-term visa-free entry can be found at the Ministry of Foreign Affairs.

For long-term stays, foreign nationals must obtain a temporary residence permit, which is necessary for pursuits such as education and employment. Those seeking long-term visas or temporary residence permits should obtain specialised advice and prepare thoroughly to meet all immigration requirements. For information on obtaining a foreign residence permit, visit the State Migration Service of Ukraine.

Investors interested in formalising their business operations in Ukraine have multiple setup options. They can choose from a wide range of legal entities such as Limited Liability Companies (LLCs) or Joint-Stock Companies. Alternatively, they can conduct activities through representative offices.

The LLC is the most prevalent business form in Ukraine due to its flexibility and cost-efficiency. An LLC can be established by individuals or legal entities, either foreign or Ukrainian, with no maximum limit on the number of founders. There is no required minimum share capital; however, founders must fully pay the initial capital within six months of registration. Registration typically takes one business day, is free of charge, and can be completed through a power of attorney.

Opening a representative office is another common practice among foreign investors. A representative office is a division of a foreign company and not a separate legal entity. It is managed by a head appointed by the foreign company and must register as a permanent establishment for commercial activities. Although registration takes longer and is less regulated than an LLC, it offers certain tax advantages, such as including expenses directly in the foreign company’s costs.

It is noted that foreign citizens of selected countries benefit from visa-free entry in relation to private, short-term travel i.e., they do not require a visa for travel to Ukraine for up to 90 days every 180 days. The full list of countries that entitle their citizens to short-term visa-free entry can be found at the Ministry of Foreign Affairs.

For long-term stays, foreign nationals must obtain a temporary residence permit, which is necessary for pursuits such as education and employment. Those seeking long-term visas or temporary residence permits should obtain specialised advice and prepare thoroughly to meet all immigration requirements. For information on obtaining a foreign residence permit, visit the State Migration Service of Ukraine.

Foreign investments in Ukraine encompass a wide range of activities. Businesses from abroad looking to enter the Ukrainian market have several options, including establishing a local presence by creating a new legal entity, acquiring shares, engaging in asset deals, or forming agreements with local partners.

Many of the restrictions affecting foreign investors in Ukraine arise due to the ongoing war. Consequently, special measures such as the martial law regime, sanctions, and capital controls have been implemented to facilitate the smooth operation of the wartime economy, in alignment with national interest. These restrictions are horizontal, meaning they apply uniformly to all investors regardless of nationality.

Additionally, foreign investors should be aware of other key restrictions, such as the regulatory and licensing requirements that govern certain economic activities and the restrictions on land ownership.

Foreign investors conducting business in Ukraine are required to adhere to the regulations of the martial law regime, which mandates specific adjustments to business operations during wartime. Key adjustments include:

- Obligation to comply with local curfew laws and follow security protocols in case of emergency alerts, to ensure the safety of their employees and stakeholders.

- Introduction of mobilisation rules, according to which

- Ukrainian employees can be summoned for army service.

- Companies engaged in ‘critical’ economic activities may be able to retain a certain percentage of their workforce exempt from mobilisation.

- Various restrictions on international trade e.g., reduced period of export-import settlements and restrictions on financial transactions.

The National Security and Defence Council of Ukraine has the authority to impose sanctions on foreign states, legal entities, and individuals. These sanctions may be based on activities that threaten national interests, security, sovereignty, and territorial integrity, or those that support terrorism or violate human rights.

As a direct consequence, any legal entities or individuals sanctioned by Ukraine are prohibited from investing in Ukrainian companies and are not allowed to withdraw their investment and/or repatriate their capital.

It is imperative for foreign investors active in Ukraine to conduct thorough due diligence on their stakeholders by consulting the State Sanctions Registry. Engaging with sanctioned parties could lead to significant operational risks. For instance, contracts may be invalidated for violating public order, or payments might be disrupted due to the freezing of assets.

In response to the challenges posed by the full-scale war, the National Bank of Ukraine (NBU) has implemented stringent controls on foreign currency (FX) transactions to stabilise the financial system and prevent uncontrolled capital outflows.

Prospective investors are strongly encouraged to follow the site of the National Bank of Ukraine, as it regularly publishes updates on easing of FX restrictions.

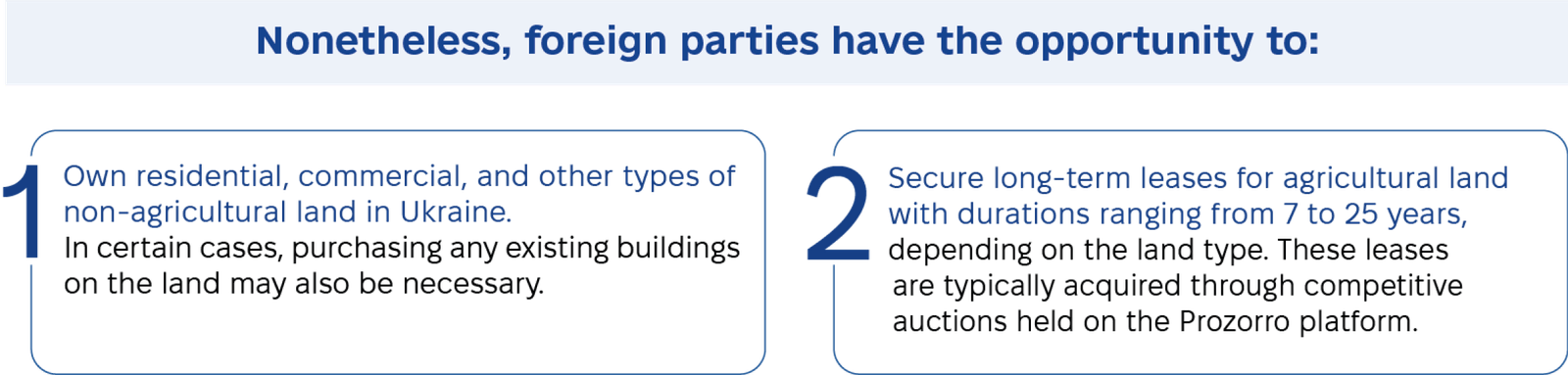

Foreign citizens and legal entities—including Ukrainian legal entities with foreign shareholders—are currently prohibited from owning agricultural land plots in Ukraine.

Recent reforms have expanded land ownership rights for Ukrainian nationals and local entities, allowing them to own up to 10,000 hectares, a significant increase from the previous limit of 100 hectares, effective from 1 January 2024. However, this privilege does not extend to foreign investors.

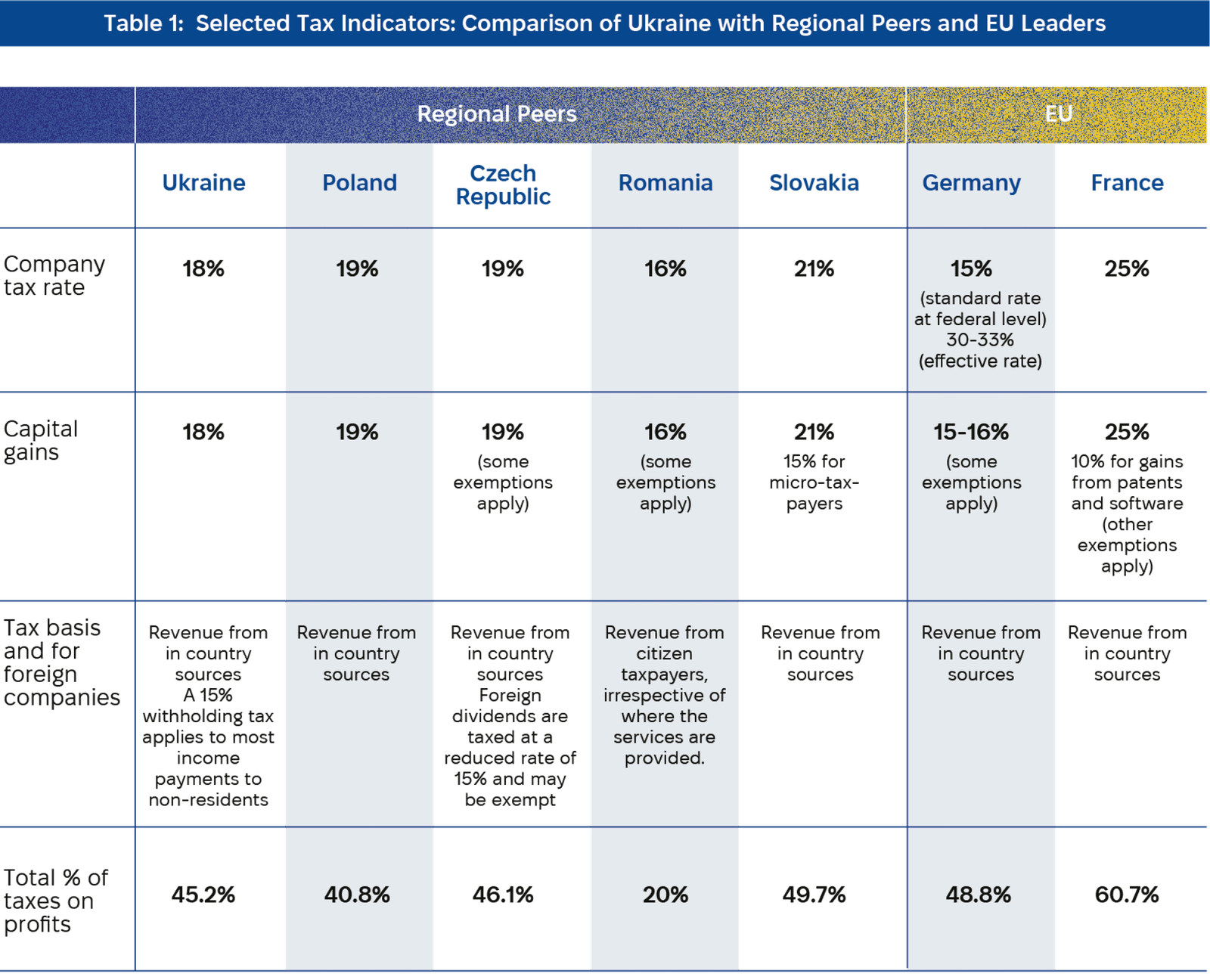

Business entities in Ukraine are required to pay corporate income tax on their worldwide profits at a rate of 18%, which is relatively low compared to regional peers. This rate also applies uniformly to capital gains, which are classified as ordinary income. For a comparative overview of Ukraine’s corporate tax rate with its regional peers and EU leaders, refer to Table 1: Selected Tax Indicators: Comparison of Ukraine with Regional Peers and EU Leaders.

In Ukraine, most corporate expenses are deductible, including organisational and start-up costs, interest payments, social security contributions, and research and development (R&D) expenses. Additionally, deductions are available for selected charitable donations, which may vary based on the recipient, such as the Ukrainian armed forces, or the type of goods and services donated, like personal protective equipment and medical devices.

Foreign companies operating in Ukraine are taxed on all locally sourced revenue and are subject to a 15% withholding tax on most income payments. However, lower rates may apply if there is a tax treaty between Ukraine and the company’s country of tax residence that aims to avoid double taxation.

Employers are responsible for withholding personal income tax at 18% and a military duty at 1.5% from salaries. They must also contribute a unified social security payment at a rate of 22% of the payroll cost. For employees in Diia.City (see Section 6.5.3 below), lower rates may apply.

Companies operating in Ukraine may also be liable for additional taxes, including local real estate taxes, state duties, and environmental taxes. Note that these taxes can vary significantly between different regions and municipalities.